My goal for this week was to break into paper trading to increase my confidence with trades and learn by making mistakes, which for me, is the best way to learn.

The first two days of the week, I had a full schedule at my day job, so I could not participate in any trades or chart watching.

$AZFL

The first paper trade that I made this week was with the ticker $AZFL. On April 7th, the stock climbed from 0.0062 at the open to 0.0073 in about 10 minutes.

The spike was connected to recent news regarding marijuana legalization in Mexico. $AZFL was also gaining lots of attention on Twitter, and the trade volume was between 2-4 million.

In the past couple of weeks, I watched several stocks that spiked in the morning continue to spike for more than 10 minutes despite being above VWAP. Even though they kept climbing minute after minute, I avoided them because they were above VWAP.

Since I was going to make a paper trade, I didn’t have anything to lose and saw an excellent opportunity to grow my knowledge account.

I planned to buy on the third green candle thats above VWAP after a dip that lasted a few minutes and try to make around 10%.

So I did just that and got in at 0.0071. Less than five minutes passed, and it started going in the opposite direction of what I had hoped. I told myself that I would get out if it dipped to 0.0069.

When it dipped to .0069, I decided to wait another few minutes just in case it started to go back up, but it continued to dip, so I got out at .0068 for a slight loss.

Looking back on the day, had I waited until the afternoon, I could have made a profit. But there’s no way I could have known or predicted that, so there’s no reason to dwell on that fact.

Sector-related news, Twitter hype, and 2-4 mil volume do not mean the stock will continue to spike even if it did during the first 10 minutes. It may be a good idea not to participate during the first 10 minutes the market opens.

On day 23 of the 30 Day Bootcamp, Tim Sykes mentions that Tim Bohen does not like to make trades during the first 15 minutes of the market open. Perhaps I should follow his example moving forward.

I’m not an affiliate to the boot camp, but as a newbie, I’ve learned so much from this series, so I wanted to make sure I provided a link. At the time of writing this, it’s actually on sale!

$BIOL

The next day I decided to play around with the screener in stockstotrade slightly and add a filter to the built-in scanners.

My scan included the biggest % gainers under a dollar with a 1-5 million volume and had already traded 500-1000 times since the open.

Here’s a great beginner’s guide for using stock scanners by stockstotrade.

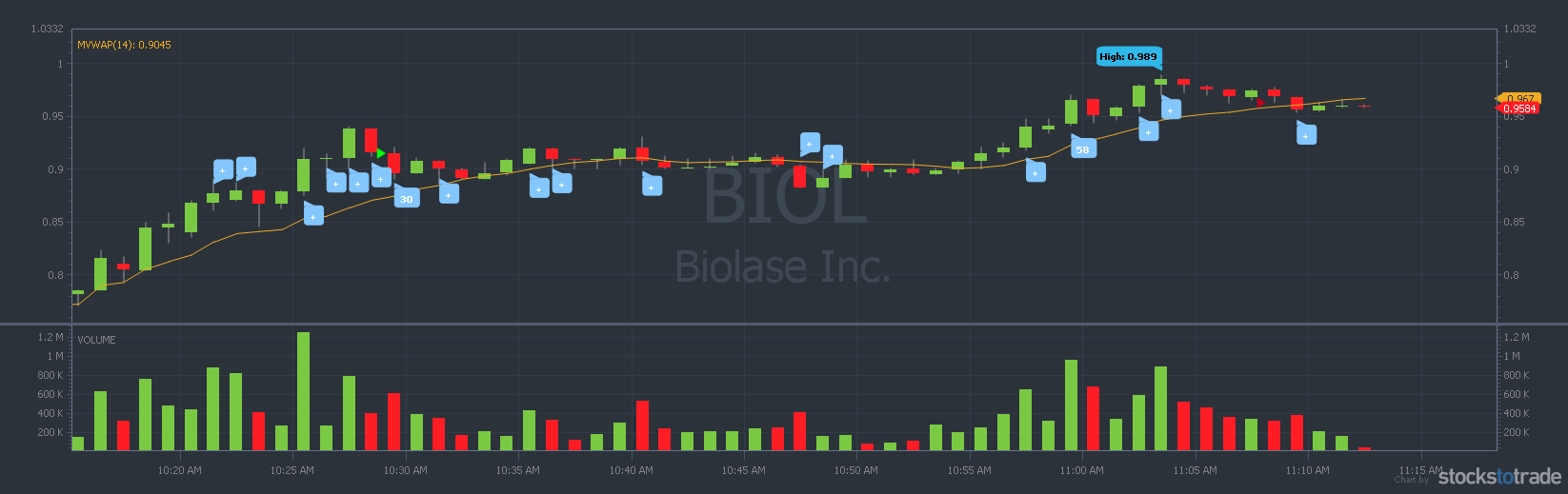

The ticker that caught my attention with the scan was $BIOL. There was around 1 million in volume, and 45 minutes after the open it spiked 15%. There was also quite a bit of buzz on Twitter and an SEC filing from a week ago.

Like the day before, I still wanted to try my hand at stocks that are climbing and above VWAP. I’ve missed these opportunities where they kept rising in the past.

I got in at 0.915 with a goal of a 10% gain and a plan to cut my losses if it starts to dip below 0.88. My entry was near the days high and above VWAP.

Neither of these are great times to make a purchase, but I needed to see for myself so I don’t make a mistake with my real account. This was another paper trade, after all.

After several minutes, the chart gave me no indication that it was going to continue to have an uptrend. Then, 2 minutes went by with green candles. Just before 11 am, it hit a new high of the day.

I placed a sell limit order for 0.920, but it was quickly passed up without getting filled, so I canceled my order. It then moved up to the high 0.90’s, so I set another limit order. A minute goes by, and nothing happens.

An order has never taken this long to get filled. The chart starts to slowly downtrend as panic sets in, and I cancel my limit order for a market order

After four more attempts, my order finally gets filled at 0.963 for a sub 10% gain. During that spike, the volume never broke above one mil like it had earlier that morning.

I had heard that low liquidity stocks could be difficult to get out of, but I had never experienced it first hand until now. Below is a great free video by Tim Sykes about the best stock volume to trade.

$RGBP

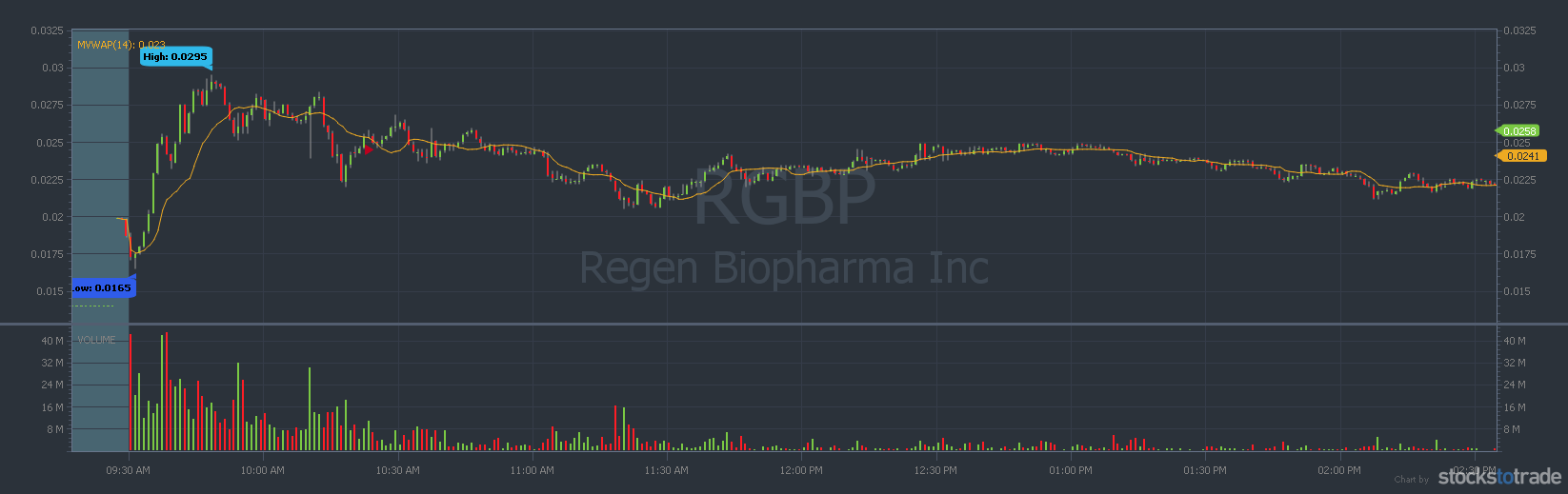

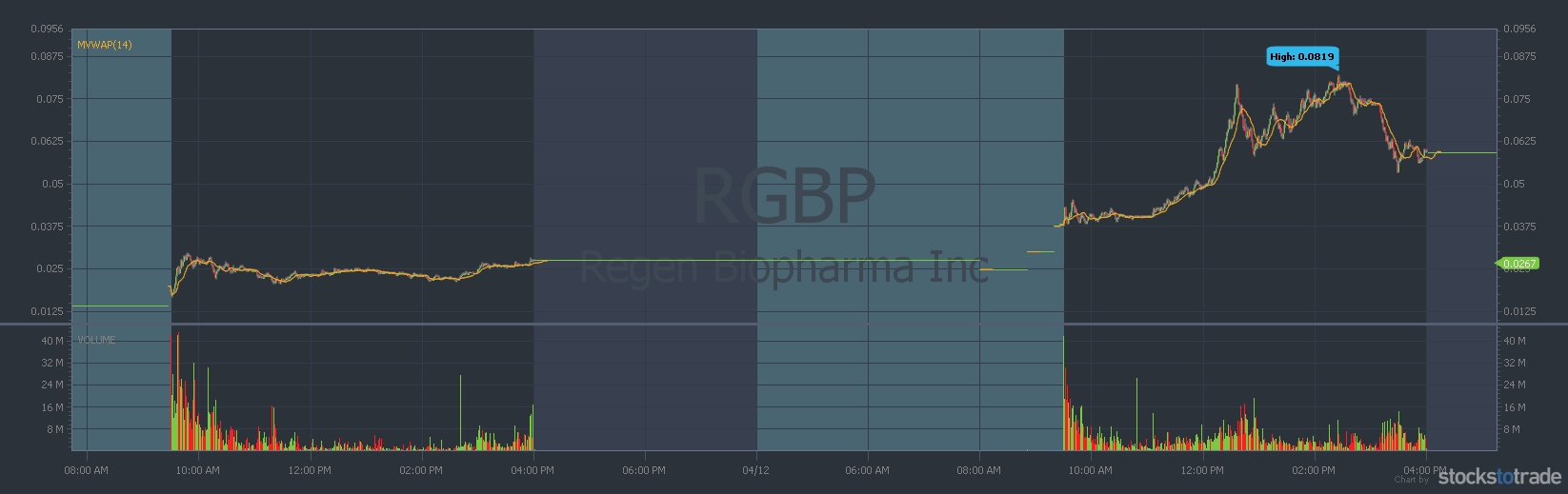

My last trade and only actual money trade this week was with the ticker $RGBP. If you have been watching the market lately, you may have seen that it climbed nearly 2500% over three days.

I was about to log off and get ready for work and complete a few chores when I changed my screener to show all stocks with volume above one mil instead of between 1-5 mil like the previous trade when I noticed that RGBP was up 400%.

I must not have been paying attention because when I checked the BreakingNews Chat feed on Stockstotrade, they had alerted it when it was up 300%

Man, I should have been paying attention to the @sttbreakingnews chat. $RGBP already up atleast 100% from the alert. pic.twitter.com/PxDzVbaqtP

— Hemerodrome (@Deliverypennies) April 8, 2021

At around 12:04 market time, it’s not spiking, just making a slow and steady climb. I began to question if I should make a purchase or just let it go and consider it a missed opportunity.

I checked the time and needed to get ready for work, so I told myself that there might not be a dip, just a gradual fall after such a huge gap up. I then got ready for work, planning to check back in around lunch.

Before I even got 2 hours into my workday, I checked the chart on my phone and noticed it had gained an additional 200% and was sitting around a 600% gain on the day. Then the FOMO set in.

Unfortunately, most of my cash available to trade was in my Fidelity account, and they were not allowing trades with $RGBP. Thankfully E*trade was, but I had only just started adding money to the account.

I took what little money I had available to trade while the rest transferred and made an entry at 0.0153.

Then I regained my focus and went back to work, as the panic of not being able to watch what happened set in. So I put a limit sell for 0.0164 and let it play out.

The end of the trading day came, and my limit sell expired. I planned to sell as close to the open as possible, so I could get out because I felt there was no way after an 800% spike that it would continue.

However, to my surprise, the ticker continued to climb in the morning on the 9th. I spent most of the day just watching that single chart.

As it neared noon market time, I decided that I could not go through the stress of not watching the chart while at work, so I put in a limit sell at 0.0245, which gave the chart some wiggle room to grow.

I’ve struggled with putting limit orders too low in the past, and they end up getting passed up before the order can be executed.

Around 20 minutes later, my order was executed, and I walked away with a nice 60% gain, but a low dollar gain thanks to $13 in commissions—another reason to not FOMO when your account lacks funds.

This stock continued to climb and is still playable when writing this, but I try not to worry about what profits could have been.

Summary

$AZFL in at 0.0071 out at 0.0068 for a 2.82% loss, great lesson about not trading in the first 15 minutes of the market open.

$BIOL in at 0.915 out at 0.963 for a 5.25% gain, great lesson on how vital stock liquidity is. Low liquidity can make an exit difficult.

$RGBP in at 0.153 out at 0.245 for a 60% gain, great lesson on FOMOing and the importance of having cash available to trade with the least bad broker.