Monday, I started the day using my screener and watching some of the biggest % gainers but made no moves. Focused on growing the knowledge account

Another day of watching and growing the knowledge account. I was too slow to catch some of the decent set ups this morning. Spent some time watching $RETC $CUBV $QLGN $DGLY and $GGII. Off to the day job.

— Hemerodrome (@Deliverypennies) April 26, 2021

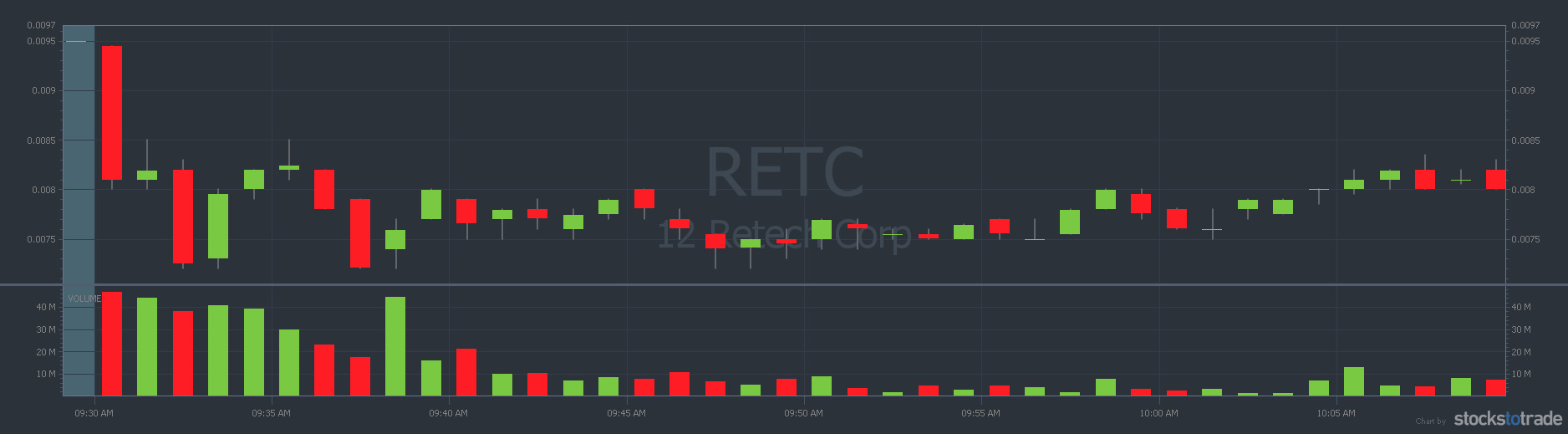

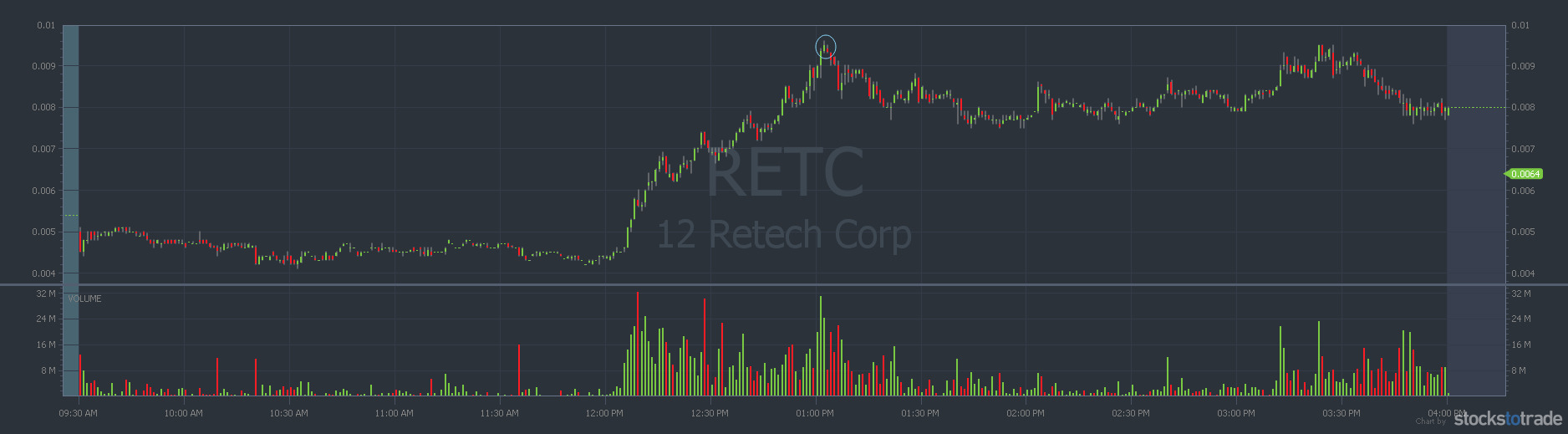

On the following day, Tuesday, I was focused on watching moves made by $RETC and $PJET.

$RETC had a huge spike the previous day around 9:45, and it spiked again between 3 and 4 pm. I planned to go for a morning spike play.

The breakout seemed to be the only news at the time, so I knew to play it safe and not buy right out the gate after the spikes the day before.

Sure enough, it was down-trending by 20% in the first few minutes of the market open.

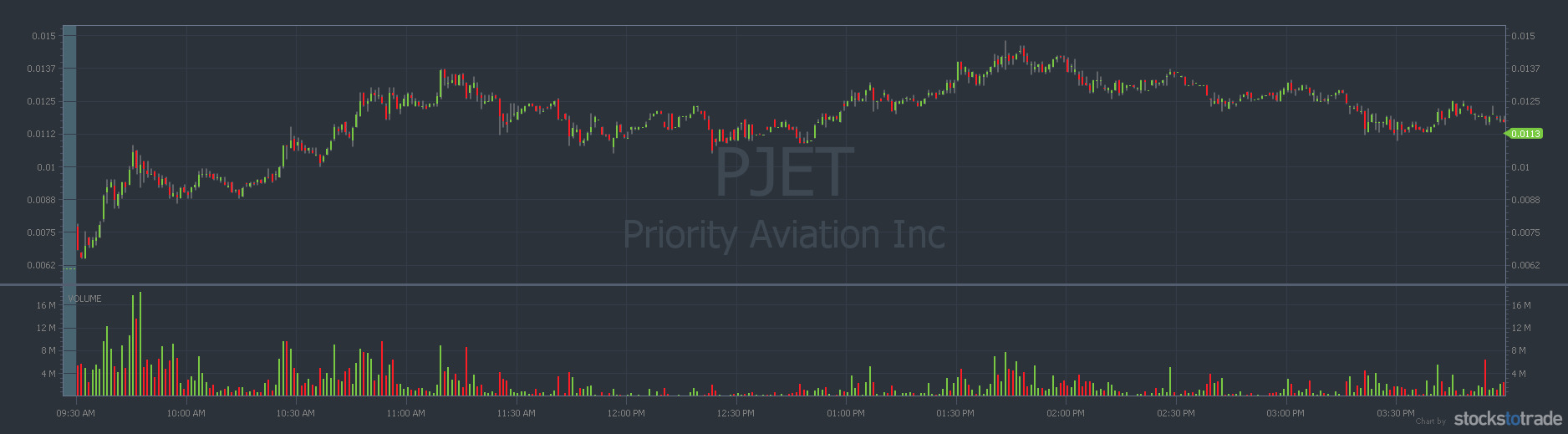

I then shifted my focus to $PJET, which was jumping between a 70% and 90% gain on the day.

A steep decline formed shortly after, followed by a gradual, steady climb back up. A pattern I’ve seen work out many times before, but I was just too nervous.

Sykes purchased around 9:45 and got out by 9:52, stating he “won’t be aggressive as it has failed too many times to hold early gains.”

It ended up having a nice little jump around 10:30, followed by a steady downtrend, then a nice cup, followed by another downtrend.

I was very frustrated with myself for not pulling the trigger when I saw the steady climb because over those 45 mins; I could have made a 40% profit.

$PJET 40% move in about 45 minutes. I need to dial in and not try to multi-task so I don't miss more great setups like this. pic.twitter.com/Dmjv4OaXQ9

— Hemerodrome (@Deliverypennies) April 27, 2021

$BPSR

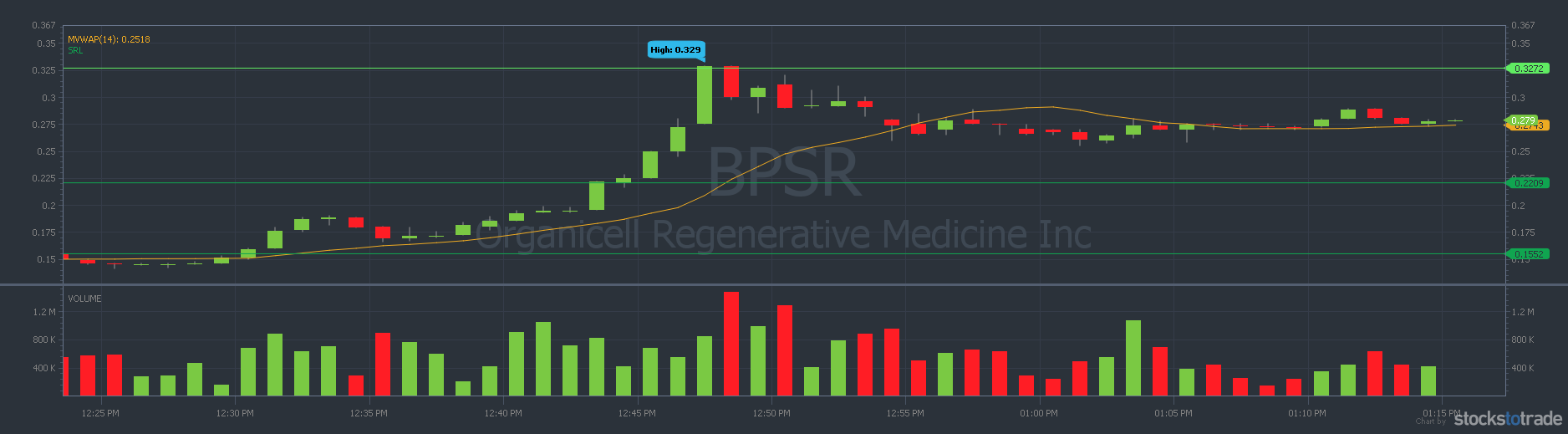

My best trade to date, in at 0.149 and out at 0.2751 for an 84% gain. Verified trade on Profit.ly.

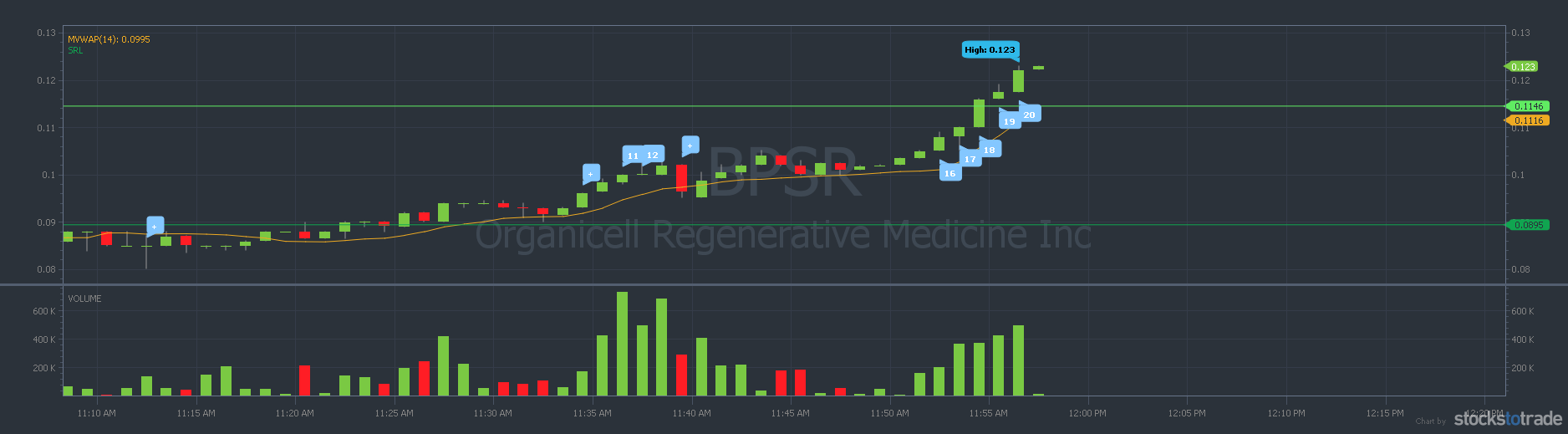

I started watching $BPSR around 11 when it popped up on my screener with a 70% gain on the day.

When checking for a catalyst, I noticed they just announced positive results of a Covid-19 patient trial in India with Trial Expansion.

The ticker was at a steady climb for a while. I watched it climb up to a 230% gain on the day.

After kicking myself for being too nervous and not making any moves, I finally decided to jump in with a plan to make a 10-20% gain with the pattern I had seen all day.

$BPSR decided to finally make a move after it climbed another 100% give or take. My plan is to make 10-20%. pic.twitter.com/9N2BSAMz8V

— Hemerodrome (@Deliverypennies) April 28, 2021

To my surprise, shortly after my execution, $BPSR started to take off, jumping more than 110% in 30 minutes.

After the 4th red candle on the minute chart, I sold all of my shares for my biggest profit to date. Had I held to the afternoon, I could have made an even bigger profit, but I was extremely happy.

$EXLA

In at 0.0275 on 4/29 out at 0.018 for a 34% loss. Verified on Profit.ly

My best trade was quickly followed by my worst trade the next day.

I lost a chunk of gains from $BPSR from a bad & pointless trade with $EXLA. I got greedy & didn't exit when I had a 10% gain & saw it turning. Like a degenerate, I held overnight, hoping for a quick morning spike to recover. Threw my education out the window with this one. 😬

— Hemerodrome (@Deliverypennies) April 30, 2021

On 4/29, I was so eager to trade the next biggest % gainer that I threw all my rules out of the window.

I had been watching $EXLA most of the day when I decided to make an entry with around $400.

Moments before I was about to pull the trigger, I had to take a phone call from a family member that I could not miss. I waited to make my entry because I did not want to be distracted.

When I returned from my phone call, my limit order had jumped $160, which let me know I had missed a decent opportunity for a quick gain.

After adjusting my position size, I just pulled the trigger, knowing better.

For whatever reason, I was super eager to trade. That should have been enough to tell me to walk away.

My goal was to profit 10-20% or get out when I lost around $40.

The following 10 minutes resulted in a gradual increase to an NHOD. I should have just gotten out then, but I convinced myself I wanted another 5-10%.

Moments later, it started to downtrend, and I was in denial.

Over the next hour, I watched my P/L go from the mid $20’s down to $-94.50.

An opportunity came where I could have gotten out at my original mental stop loss, but I again somehow convinced myself to stay in.

As the market close approached, I told myself I would recover during a morning spike the following day.

Before the open, there was already an order queued up to sell 10000 shares. I sold my shares as quickly as I could with a 34% loss.

Many times, when you think you are acting greedy, you are. If the chart is not doing what you want, take that low % gain or loss and get out before it becomes a significant loss.

Tim Sykes has a great video below with the three key indicators he uses to know when to cut losses quickly.

On the following Monday, I was too slow to catch the good opportunities I saw. So, again, I just worked on the knowledge account.

During the open, my scanner showed $TGGI was up 50% right out the gate. I watched it quickly climb another 50%+ before starting to down-trending in the first 5 mins.

$TGGI No action from me but it was fun to watch run from 50% to 120% gain for a HOD before turning down. pic.twitter.com/UyX1eXbg65

— Hemerodrome (@Deliverypennies) May 3, 2021

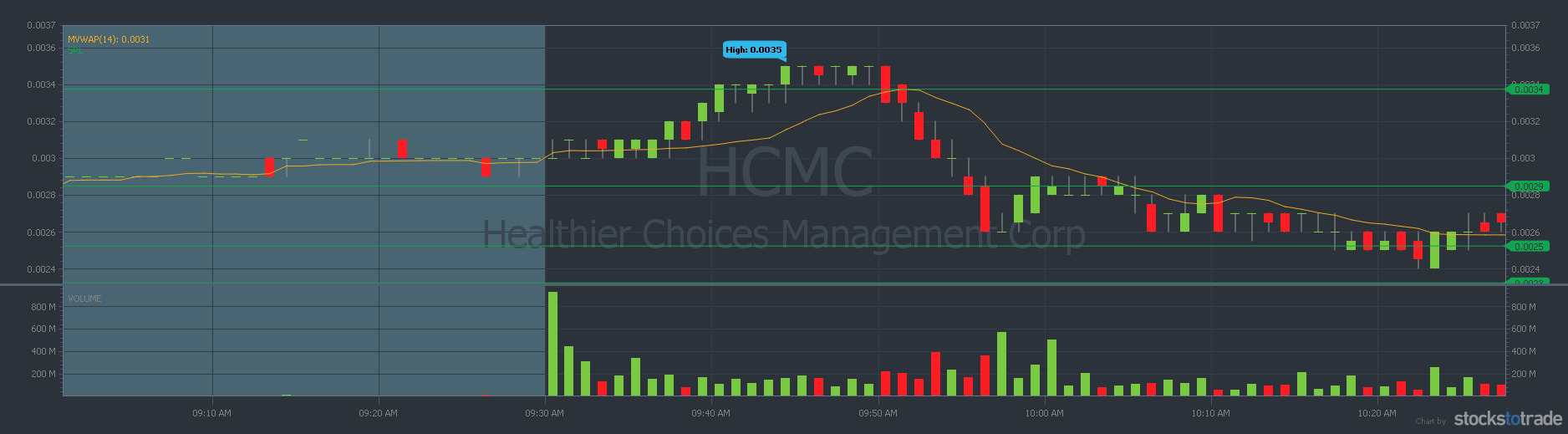

In Tim’s Alerts chat on Profit.ly, someone (I should have written it down to give credit) in the chat mentioned that the WSB Reddit was pumping $HCMC that day.

When you check the chart from that day, it’s a very obvious pump and dump that ended just as quickly as it started.

$RETC

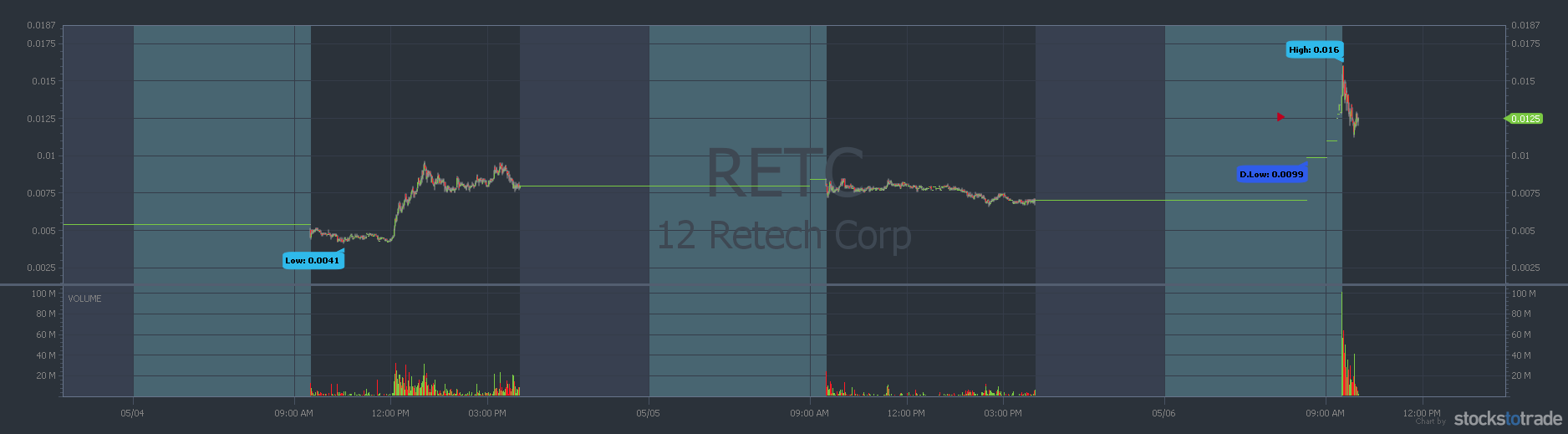

Degenerate trade that worked out. In on 5/4 at 0.0095 out on 5/6 at 0.0126 for a 32% gain.

On Tuesday, 5/4, I saw an alert in the BreakingNews Chat on STT about a George Sharp tweet essentially confirming that $RETC would be moving with $GVSI

Yer dern tootiin'. https://t.co/bgNLbXaWeR

— George Sharp – Advocate for truth in the OTC (@GeorgeASharp) May 4, 2021

I was just too hesitant and ended up finally making an entry only to find it was at the top. I started watching $GVSI, and it looked like it was starting to trend back up.

However, I ran out of time and had to go to work. I was hoping that more people would see the tweet later that day and make a purchase the next morning.

The next day, it was down-trending but not enough for me to worry. I was waiting on news about a rumor that GS would be taking custodianship on the ticker.

I was also a little numb from my loss with $EXLA and still had room to lose from my $BPSR gains.

Truthfully, not a risk that I would take again. I would still feel the same if I had made a 1000% gain.

Finally, that evening after the market had already been closed. GS tweeting about being granted custodianship.

Court awards me custodianship of $RETC

— George Sharp – Advocate for truth in the OTC (@GeorgeASharp) May 5, 2021

With that news, Twitter was on fire about $RETC, with many speculating huge gains the next morning. I slept well that night.

On the morning of 5/6, the ticker had a significant spike right out the gate. Had I not let greed get the best of me, I could have beat my best trade from the week before.

After it started to downtrend and did not look like it would be spiking again anytime soon, I got out with a 32% gain.

Overall, I was pleased with how it turned out but, upset I let greed get the best of me again, and I missed out on gains. Funny how that works.

$ISNS

In the middle of my trade with $RETC, I made a paper trade on 5/5 to help boost my confidence and work on discipline with the ticker $ISNS

Entry at $9.00 and out at $10.04 for an 11% gain. Verified trade on Profit.ly

While in the SmallCapRockets chat room on STT, I was alerted to a good entry for the ticker $ISNS.

It was considered a good entry point because it had spiked in the morning, held the morning spike, then approached the morning high before proceeding to breakout.

Truly amazing in-the-moment advice. If you have STT, I highly recommend getting the SmallCapRockets add-on.

Matthew Monaco, John Papa, and Tim Bohen are the main moderators and want to help you become a better trader.

Summary

Some solid trades and some not so solid trades. Great two weeks of learning!

$BPSR: My best trade to date, in at 0.149 and out at 0.2751 for an 84% gain.

$EXLA: My worst trade to date, in at 0.0275 on 4/29 out at 0.018 for a 34% loss.

$RETC: Lucky recovery, in on 5/4 at 0.0095 out on 5/6 at 0.0126 for a 32% gain.

Watched but made not moves: $PJET, $TGGI, $HCMC, and many others mentioned on Twitter.