$GGII

The week started without any trades in the books. I missed a great double bottom breakout shortly before 2 pm with a nice 20% gain with the ticker $GGII

$GGII I've really got to work on taking action. Watched it go from the high .07's to here. About a 20% increase. Will be ready for the next pic.twitter.com/oaYP9JOSMc

— Hemerodrome (@Deliverypennies) May 10, 2021

After vowing not to miss another great setup, I was late to the game on a beautiful breakout with $GGII the following day, the 11th.

My goal during my entry was to make a quick 10% and get out. Since I kept hesitating, I knew that it probably would not be long before a downtrend if I did get in.

I decided to make an entry and got in at 0.1524. In the first few moments, I had hope. I was up around 5%, and the candle teased that it would continue rising for another minute.

The market had other plans, and the ticker started to downtrend. With a large number of sellers, it became difficult to get out.

During my initial exit, I set a limit order sell at 0.1612, but the chart quickly passed it up. Worry began to set in that this could turn into a significant loss quickly.

I canceled my limit order and decided to get out using a market order because I figured it was my best bet to get out before the loss piled up.

Seconds later, my broker filled my sell order at 0.1562 for a 2% gain.

Due to broker fees (that I will happily pay to make the volatile trades in the OTC market), I came out with a loss of around $3.

$GGII late to the game with my entry & had delays getting out. Small 2% gain. I am happy that I stuck to the rules and cut the loss quickly. pic.twitter.com/ayYsgIBPYA

— Hemerodrome (@Deliverypennies) May 11, 2021

As late as my entry was, looking back, I probably should have stayed away and considered it a missed opportunity.

Overall, I was happy with my exit. As I have mentioned before, I have struggled with cutting losses quickly.

This trade was great for growing the knowledge account. Trade is verified on Profit.ly.

Sykes made perfect entry and exit and linked to this pattern in a tweet.

PERFECT $5,000+ profit on $GGII on the classic https://t.co/4lKUY5B6aw pattern today was laid out premarket here https://t.co/PtndtzAHhz this is allllll about preparation meeting opportunity, who else was prepared? Or are you going down with the ship on $DIA $SPY $QQQ $LOTZ $LTNC

— Timothy Sykes (@timothysykes) May 11, 2021

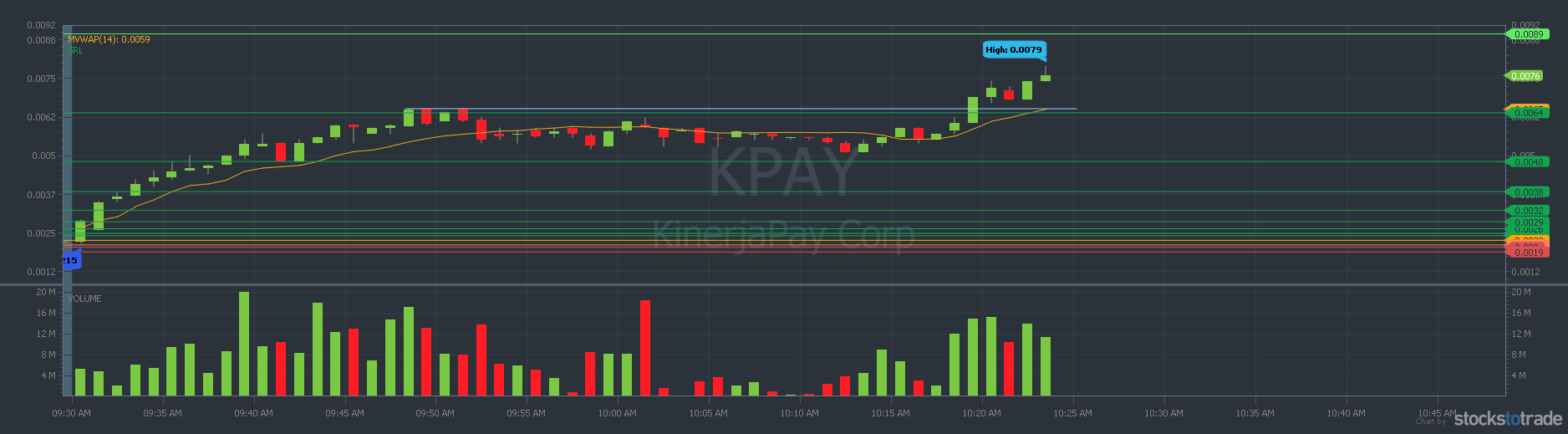

Around 20 minutes later, I was late to another great set up but this time with $KPAY, and I was smart enough not to try and make a late entry.

A pattern we saw last week, and I think one of my favorite patterns. It either results in a quick break out or a breakdown.

In this pattern, the ticker spikes in the morning, followed by a horizontal channel. When the channel hits that high again, it typically results in a breakout as it did above or with $ISNS from last week.

If the chart is going to break down, it usually does before the first 30 mins to an hour and never comes close to the high from that morning.

Stockstotrade has a great blog post written by Tim Bohen on continuation patterns. You can get it directly by clicking the article below.

https://stockstotrade.com/continuation-patterns/

The next day, I did not make a trade, but I did watch a couple of great setups with $GGII, $BRGO, and $HTZGQ

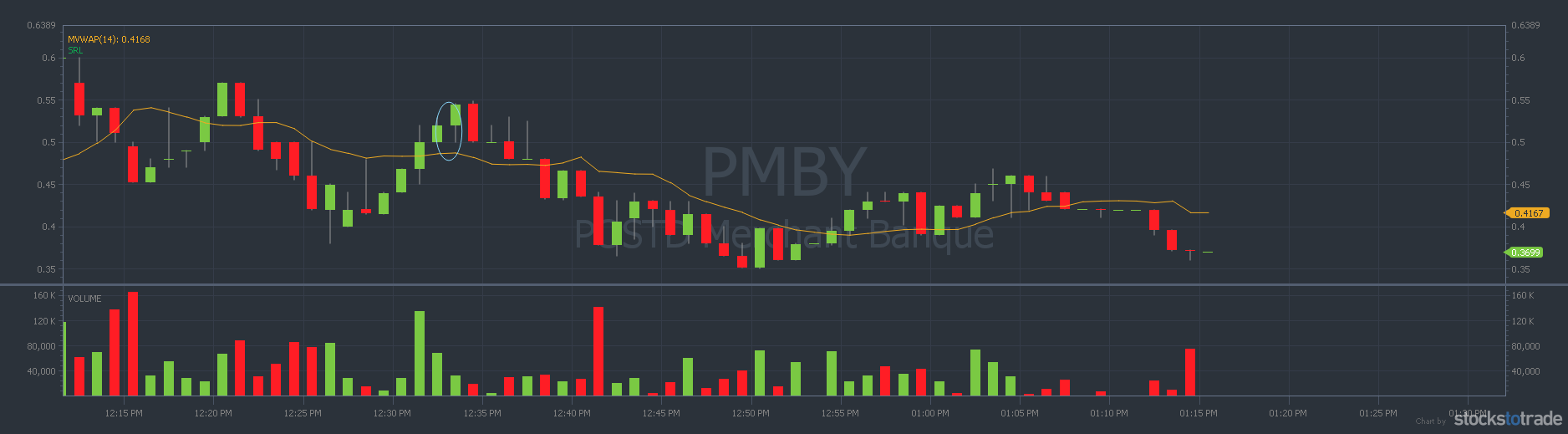

$PMBY

On the 13th, I was able to watch to market for almost the entire day. I’m starting to notice that on days like this, I make bad trades.

Most of the tickers that I watched did not result in good setups throughout the day, and if they did, I was too late.

Eventually, my trading day was coming to an end, and I needed to start getting ready for my day job.

This made me anxious to make a trade since I was given most of the trading day and did not make one.

I was watching the ticker $PMBY, which had made insane gains earlier in the day. Knowing better, I decided to find an entry instead of logging off and getting ready.

I hesitated a missed the bottom of the final line of the “w” on the chart.

Moments later, I made an entry and the top of that “w” at 0.52, which immediately followed with a sell-off instead of a breakout.

I decided I had plenty of time to get ready, so I wanted to see if it would make a come back in the next 20 to 30 minutes.

The chart looked like it was starting to consolidate at this new lower level, and I had waited as long as I could.

I made my exit at 0.36 with a loss of around 30%. Trade is verified on Profit.ly.

Going forward, I have decided that an hour before I need to go to my day job, I will log off. This way, I hope to help keep myself from making poor rushed trades.

I also need to start thinking like Timothy Sykes says I should: a sniper. If I hesitate, that’s it; I’ve missed my shot.

At that point, I need to look for another perfect setup and not risk taking a bad shot.

Not sure what I mean? Check out this excellent blog post by Timothy Sykes by clicking the image below.

Summary

$GGII in at 0.1524 and out at 0.1562 for a 2% gain.

$PMBY in at 0.52 and out at 0.32 for a 30% loss.

I need to focus on having patience and trade like a retired sniper.