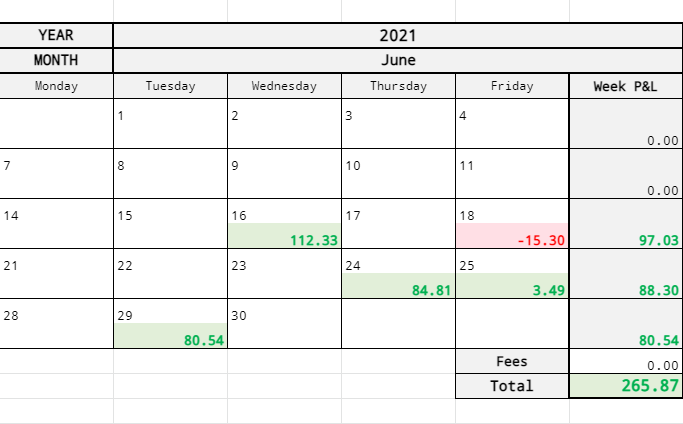

Like a red to green breakout, I left the month of May red and gapped up the last 2 weeks of June for my most profitable month since I started getting my feet wet in February.

Compared to my previous most profitable month (April), I made 218.407% more profit this month.

Now that things are starting to work and I understand why they are working, I need to double down on my studies and trading rules.

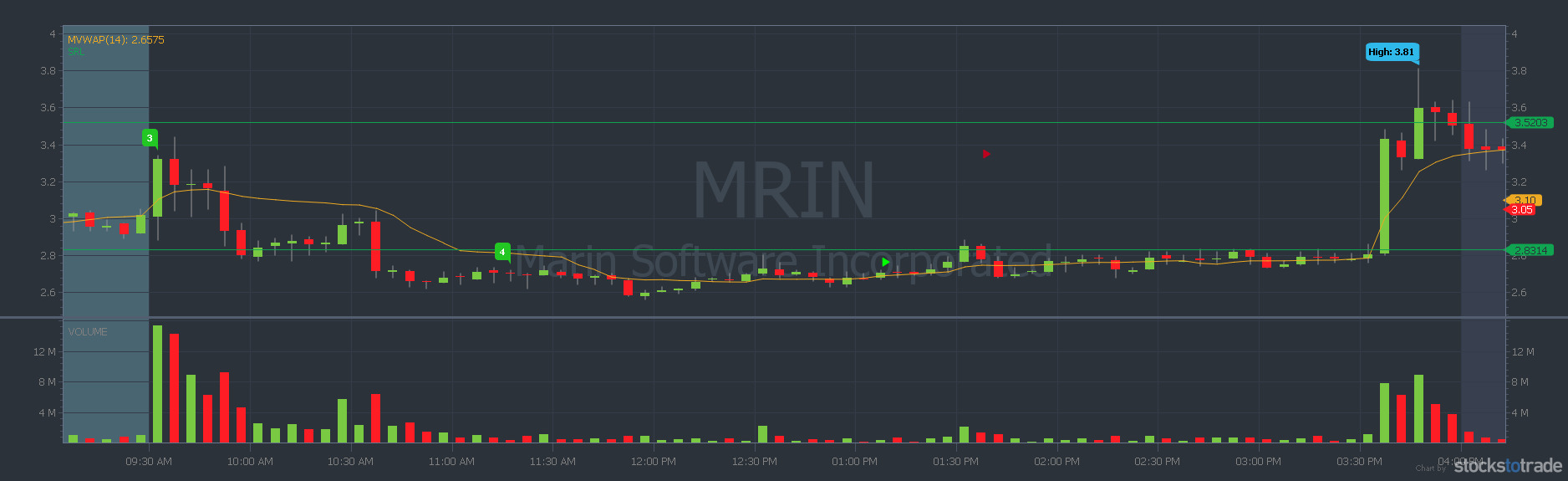

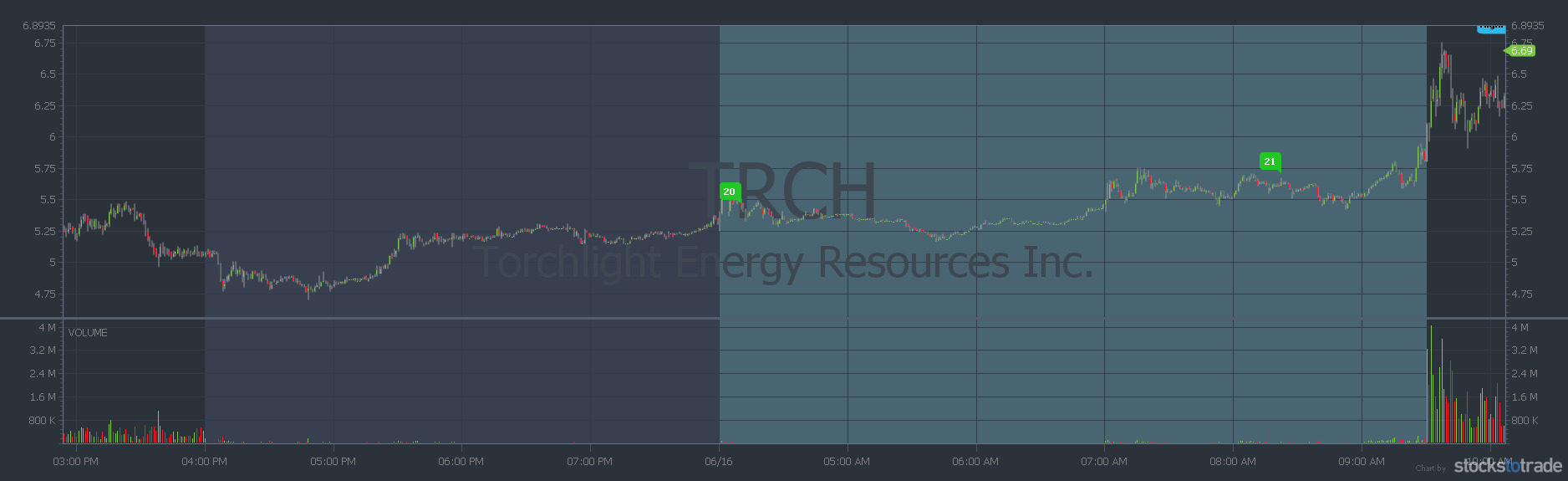

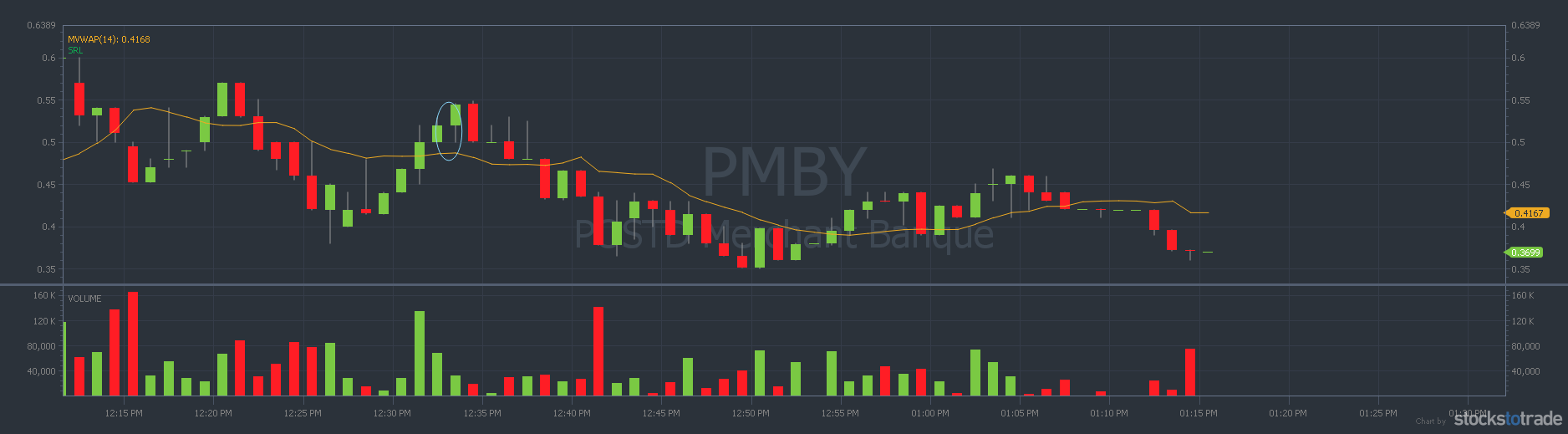

Let’s dive into the changes I made this month that I think are the catalysts for my best month.

Continue reading “June Trading Recap: My Best Month By Over 200%”